An Interview with Henry Turner, Author of The Corporate Commonwealth

#

An Interview with Henry Turner, Author of The Corporate Commonwealth: Pluralism and Political Fictions in England, 1516-1651

Published December 2015

Introduction: Henry Turner is an Associate Professor of English at Rutgers University and the author of, among other books, The English Renaissance Stage: Geometry, Poetics and the Practical Spatial Arts (Oxford UP, 2006) and Shakespeare’s Double Helix (Continuum, 2008). I contacted Turner about an interview for this special issue of NANO after reading two of his articles on the corporation—“Corporations: Humanism and Elizabethan Political Economy” and “Towards an Analysis of the Corporate Ego: The Case of Richard Hakluyt.” In the first, he analyzes how shifts in the way economic profit was valued politically, culturally, and ethically led to the emergence of the joint-stock corporation as a significant force in Elizabethan England. In the second, Turner looks at Richard Hakluyt, an early historian, geographer, and promoter of English colonialism, who was a founding member of the Virginia Company. Hakluyt’s travel narratives provide Turner with a rich body of material for the analysis of the joint-stock, limited-liability corporation in its infancy.

We met in January 2015 at the Borough of Manhattan Community College in New York to discuss the corporation and his interest in it. Our conversation started with Turner recounting what drew him to look at the early modern period’s relationship to the corporation before then moving to a dissection of corporate ontologies. We then considered the shifting relationship between sovereigns, economics, and corporations before reviewing Turner’s analysis of the corporate unconscious in the “Corporate Ego” article. Lastly, we talked about what it might mean to reclaim the idea of corporateness for egalitarian, community-minded purposes, and we ended by thinking about what recent landmark decisions in corporate law signify in the long view of the corporation’s history.

• • •

Turner began with a description of the importance of medieval power structures, especially the role of the king.

Henry Turner: As the king’s lawyers argued, the king’s natural person is the location of everything we think of as being unique and particular, something that can’t be transferred—the body and mind—but something that actually endows the corporate body politic with certain characteristics. They pointed out that you can’t pledge allegiance to an invisible, corporate body politic: you can only swear allegiance to the natural person of the king.

The question of corporate body and corporate person and how they are related to one another in the individual natural person of the king was a central one to early modern lawyers such as Francis Bacon and Sir Edward Coke. My main interest lies in how this theory of the king’s two bodies relates to the actor and the character that the actor “personates,” to use the term from the theater of the period. If we look at many of Shakespeare’s plays, for instance, we see how the theater dismantles or demystifies some of the mystical ontology of the king’s two bodies that still informed the law of Shakespeare’s moment.

The formal relationship is very similar between the actor and the character. Shakespeare is very aware of this, and there has been a good deal of criticism about Shakespeare’s plays and the way that he explores this idea. One example would be the climactic scene in Henry IV, Part I, when many different people dressed as the king wind up on the battlefield as a tactic to confuse the enemy.

Hamlet can [also] be read as a play about a large transition in corporate ideas. The ghost who opens the play is a figure for the king’s ghostly body, the legitimate body politic that has been peeled away from the king, as it were, and now it’s stalking around and doesn’t have a natural body anymore. But it’s also a kind of character: I think of it as the shell of a character. The play is very interested in the idea of theater, of course: the first player, for instance, [provides] an amazing demonstration of mimetic ability, which Hamlet watches and which inspires him to put on the Mousetrap.

Fig. 1: Act 1 Scene 3, The Ghost of the old King Hamlet (Greg Hicks) appears at night to Hamlet, Horatio and Marcellus. 2004. Photo by Manuel Harlan for the Royal Shakespeare Company.

It seems to me that in Hamlet and in the Roman plays, Shakespeare’s interested in the relationship between actor and character, and what the nature of character is—this artificial form of life. I’d like to make an equation between that artificial form of life that’s mimetically produced and the kind of artificial person, or the kind of fictional person, if you like, that the corporation is.

The other side [of my interest] is the corporation as an aggregate, in groups of people coming together to pursue some activity that can only be pursued in a collective way. We tend to think of this group activity as something that’s organized and structured and mediated by contracts, although this isn’t always the case.

The exciting thing for me has been to use these two aspects of the corporation to shed light on the corporation’s multiple ontologies. In the book I’ve just finished, [The Corporate Commonwealth: Pluralism and Political Fictions in England, 1516-1651 (U of Chicago P, 2016)], the biggest question for me has been: what are different ways of thinking about the ontology of the corporation? What makes them real? What makes them have a kind of being? How do we define the word “real” and “being”? Having a capacity for action? Having responsibility? Having a character and personality? Having a speaking voice? Having a memory?

You asked me [prior to the recorded part of this conversation] if corporations have a personality. If you think about advertising and branding, branding seems to be the essence of modern corporate culture in the narrow sense of commercial culture, and of what’s often called corporate responsibility. Corporations like RJR Reynolds or any of the big tobacco companies or many other companies purchase art collections or put on art exhibits or other nonprofit actions, and their purpose, of course, is to buy a personality for themselves, to buy an ethical conscience for themselves to compensate for this other activity that they do. It’s a little worrisome to think that we live in a world where all forms of humanistic value or artistic value or artistic forms of expression are becoming alibis for corporate profit. If you look at cultural institutions, you can see them turning into for-profit entities at many different levels.

When you try to talk about what the character or the personality of a corporation is, you can’t do it without talking about all these speech acts or whatever you would like to call them. This is why I’m interested in a cultural studies approach to corporate speech, if you will: to undertake an ecology, as it were, of all the different forms of speech that corporations are using today, all the different platforms, from Twitter to print media to physical spokespersons like Michael Jordan for Nike—and ultimately, above all, formally empty icons like the Nike swoosh.

The question to ask about Nike in this regard is this: is the personality of Nike as a corporation exhausted—is our account of Nike as a corporate person exhausted—if we refer to its legal incorporation, its chartering in the state where it’s registered and whatever its legal status is? I think not. I think that the “being” of Nike—if we’re going to ascribe a being to this group person that’s different from the sum of its parts—that surplus “personality” has to be found in these forms of public speech, this self-mediation that the corporation produces. It exists more in the Nike swoosh than it does in the charter of the corporation. You can choose any corporation you like: the importance of icons, of brands of sports teams or universities is that all of these logos are formally empty; they don’t actually have any content. Nike has figured out a way to get you and me to endow our personalities into the corporation.

That’s a typical example of a kind of ventriloquism, a zombification, a vulturing, or a vampiristic relation—certainly these are negative terms. At the very least, it’s a delegation on our part every time we wear a baseball hat or we wear a pair of sneakers. We endow Nike with our most intimate ideas, our associations, our perceptual experience. You can just imagine an ad—it probably actually exists in some version, on a giant billboard somewhere—that is nothing but an amazing image—a mountain top, or sunrise, or something like that—that is a fantastic phenomenological moment for someone—looking at that landscape after you just climbed that mountain—and at the bottom of the image, there will be a little swoosh. If you want to give an account of the corporate personality, then it has to be bounded by that billboard.

This is why I break the corporation into four basic ontologies that capture (roughly) the many ways it’s normally thought about.

The first is the mystical ontology. You see it in the king’s two bodies or the holy trinity, the three-person God as the original corporate figure, the Eucharist, the image of Christ. These theological problems then get extended into political sovereignty and kingship; additionally, these theological problems have a very complicated history [that mixes] with philosophical dimensions [of group identity]. And even legal sources encode the mystical.

The second is the mimetic ontology of the corporation. Mimetic is a very broad word. It doesn’t just mean a representation of reality—it means something like a performative “embodying forth” of an idea the way that an actor does. Theater illustrates this dimension very well.

The third is what I call the representational ontology of the corporation. I mean this in the political sense: how does a parliament become a corporate body? How does any elected body of representatives? The difference from the mimetic ontology is that in the representational ontology, you are a spokesperson: you speak for the corporation, speaking for someone else, but no one confuses you for the corporation. You’re an attorney that has been hired by the corporation to represent them, or you’re my elected representative—no one thinks that you’re Henry Turner, but you have my voice.

In the mimetic ontology, in contrast, you’re acting as the corporation; you’re trying to be the corporation. Incidentally, it was [Thomas] Hobbes’s great effort in Leviathan to pull these two ideas together.

The fourth ontology is what I call the materialist ontology of the corporation. In our earlier examples, it would be the way we described the many different material substances that the Nike swoosh is printed on: the shoes, the t-shirts, the billboards, the media platforms, all the hardware that goes into broadcasting the media energy. It describes the various ways in which there is a physical, durable network of concrete objects that enable [corporate representation] and in turn they become signifiers. The commodity is ultimately the best example; Marx gave us a materialist ontology of some of these ideas. In the analysis of the commodity form, you can find some really exciting theoretical insights into the ontology of the corporation. In Bruno Latour’s work, actor-network theory has given us a way of doing this, too—in some ways I think Latour’s theory is simply a very extended meditation on Marx’s idea of use-value.

These four ontologies seem to be four ways of thinking about the corporate idea, which we can simply define as any group that’s larger than the sum of its parts, or different than the sum of its parts. Maybe it’s smaller—in any case, it’s distinct.

The legal dimension is really important scaffolding for these things. I have a friend who calls the law the “soft skeleton” of the corporation: it’s pliable, it holds things together. But I think my problem with a lot of the discussions of the corporation is that they stop at legal accounts of the corporate personality. This is not to say legal accounts aren’t important. They are. The law is a mode of discourse that makes things real. But I’m not sure that other forms of media representation and your participatory wearing of the t-shirt is any less important than the law in making the corporate personality of Nike real.

Without looking at the relationship between legal definitions and other kinds of definitions that are equally pertinent to determining the reality of the corporate person, we can’t talk about the reality of Nike—we can’t even begin to talk about the corporate person that is Nike—if all we do is talk about its legal personhood.

In my book, I make a distinction between legal incorporation and a species, a larger genus, which I’m calling corporateness, the whole group concept. You can say that I’m using the concept too broadly, and that may be. But I’m interested in using this idea to think about all forms of group and collective options and group action and groupings, especially institutionalized, enduring groups that have some kind of recognizable personhood. These things are all around us.

This would be more familiar to people who work on the 19th century, a century full of volunteer organizations of all kinds, or obviously the medieval period, where your public identity as a political person isn’t just defined by your relation to a state as a citizen—it’s your membership in many overlapping groups, and each one has particular rights and histories and each one has its own symbolic economy that gives it its sense of purpose and community. A lot of your own sense of yourself would come from your membership in these communities. I think it’s important to try to expand the spectrum of corporateness and defend it in order to take more of an account of these kinds of groups, especially the institutionalized forms of group life that we belong to, and how they work.

Jeff Gonzalez: In the early-modern period, which is the focus of much of your work on the corporation, we see many of the current features of the corporation established. For instance, in John Micklethwait and Adrian Woolridge’s The Company: A Short History of a Revolutionary Idea, they suggest that colonization is so risky that it in some ways gives birth to the limited-liability component of the corporation.

HT: Yes it does, but there is a fine distinction to be made between a partnership and a corporation. Banking agreements and trading agreements and agreements among individual merchants, and even among small groups of merchants, and increasingly also the kinds of contractual forms of representation and the ideas of credit and other abstract forms of accounting and value that you need to manage highly capitalized projects—these kinds of collective forms of investment and industry have existed for a long time.

In these examples, merchants bring their capital, and they agree under a set of rules to trade individually according to rules they all recognize. But this model can be distinguished from a group of people who come together to coordinate and collectively contribute money to a collective pot [of money or resources] which is then is used and spent collectively, and from which profits are distributed according to the amount of initial investment.

The charters that you see in Hakluyt and the new joint stock companies of the Elizabethan era—companies that are chartered as corporate bodies—have this additional level of coherence and rights that are allocated to them. They are given what are essentially monopoly rights to explore certain kinds of trade and to trade certain kinds of products, in certain regions and places and with groups of people. But they also gain protections against lawsuits. Although, most of these early corporate ventures ended up losing everything. They weren’t very successful.

JG: And the corporation’s peculiar makeup helps with long-term ventures. There’s a difference between a merchant backing a one-off journey and the Hudson Bay Company, where it’s a whole series of missions under the auspices of one corporation.

HT: Exactly, and you can immediately see that the task extends over time. One of the signatures of a “corporate” idea is that all the members could die or be replaced and the company would continue to exist. And corporations allow for a much larger scale of participation and a much more attenuated sense of participation. That’s why in Hakluyt when you start counting up all the different members, you have to distinguish between the levels of participation—between, say, full initial charter members, a board of governors that takes an executive decision making capacity for the corporate group, and more passive investors who are donating money or maybe time or materials to the corporate body. The idea would be that the formal, legal, artificial device of corporateness lets the skin increase, as it were, and lets those levels of participation increase and become more complex.

Now, as that increases, all the forms of writing that the corporation produces also become more complex. That’s what got me interested in Hakluyt. Suddenly you have to keep an account book in a certain kind of way, you have to keep a list of objects in certain ways, you have to think about how different objects can be combined and which ones can be converted into other forms.

The travel narratives that Hakluyt publishes address these parts of the process; you see every dimension of this phenomenon we’re describing, represented in writing. The idea for Hakluyt is to make a formal taxonomy of different kinds of writing that are parts of these corporate processes. The corporate person lives in these kinds of speech acts and representations of its activities. Some are commands, some are descriptions, some are calculations, and some are exhortations or articulations of principles and encouragements.

Natural persons are the spokespersons, but it’s not always clear whom they’re speaking for. Are they speaking for themselves? Are they speaking for the company? How could the company speak except through these people?

JG: It’s interesting, too, that Hakluyt is inventing things: the corporation invents capabilities as it goes. These new things then become part of what the corporation does afterward. I’m very interested in the ways that corporations diversify, because it suggests that the origin isn’t determinative or strictly definitional. For example, Christine Labuski and Nicholas Copeland’s The World of Wal-Mart: Discounting the American Dream explains that Wal-Mart is trying to get into cities by taking over the “Dress for Success” program, which has helped establish Wal-Mart into Chicago. They’re playing with their red-state identity, deciding to say “Wal-Mart can also be this.” [Editor’s note: Labuski and Copeland have an article in this issue of NANO]. And that’s not untrue—the corporation can’t betray its identity, because it never really had a true or authentic identity.

HT: This is where the whole idea of having a legal personality—the soft skeleton—shows itself to be so important, because corporations do change in their purposes and their activities: the kinds of products they make and put in stores, their advertising, their self-image. The variety of forms that are circulating in the ecology of this corporate entity are all significant. The idea of corporateness shows itself to be a very plastic idea. It makes difference possible within identity. It sounds very Hegelian: it changes, but it stays the same.

The legal form captures the way identity comes to be recognizable through the fact of persistence in time—in and through and maybe even beyond difference.

We can think of it as the problem of the “open unity,” or the “open whole”. A corporation has an identifiable form and a wholeness, but that wholeness isn’t closed. I’ve often thought of it as having the integrity of a cloud rather than a child’s building block, with clear edges. When you get close to a cloud, you can see that it isn’t solid, and you aren’t sure when you are inside it and when you are outside it—it becomes a fog. Nevertheless, from a distance it seems very clear that the cloud is a defined thing, with edges and boundaries. The corporation works in a similar way, it seems to me. And other ideas, too, like the idea of a “public.”

JG: A lot of what you quote from Hakluyt in the letters to Elizabeth justifies corporate behavior by tying those behaviors to, if not the state, then a nation-building project. When does this stop? Or is there always a relationship between the way corporations justify their actions and the state that surrounds them?

HT: This is a very difficult question. Let’s bracket for a moment what the state is: in Hakluyt’s period, we can call it the sovereign or the Crown. Even to take the clearest cases of joint-stock companies that are chartered by a royal act, even in these cases, the King isn’t really creating something out of nothing. There are people who preexist that founding moment; they have activities, they have interests, they have capital, they have a history, they have experience, they have preexisting group formations. What’s actually happening is that these group efforts are now being recognized by the King as the sovereign authority and being pulled into a set of legal relationships that allow the sovereign to assert his authority and his jurisdiction over them. So you could say that the act of creating a corporation on the part of the sovereign is as much about the sovereign asserting and performing his sovereign power as it is creating an entirely new thing. Does a sovereign create a corporation, or does a sovereign recognize the corporation? It’s an old pluralist question.

So you have this problem: what is the relationship between the entity that has been created and the sovereign that created it? I feel that there’s quite a bit of space between these two things. Corporations in early modern England are doing things that the crown could never do on its own because the crown doesn’t have the resources to do them. They are operating under a charter that gives them their own ordinances and their own self-regulations, their own rules, their own self-governance. And the rights that the charter gives them are fairly independent. There’s no oversight; certainly when they get out of England, they find themselves in overlapping legal jurisdictions and legal systems and legal claims to territory, not to mention native claims to territory. It seems to me that the activities of these corporate bodies have a lot of freedom and quite a bit of autonomous power, whatever the King’s charter might assert.

JG: The more I think about the question, here’s what I mean. Nike’s charter probably does not say that it wants to better America, if it even identifies itself as American. In its public statements, it may say things about wanting to improve public health. But it doesn’t think of itself as a particular prosthesis of the state—it doesn’t justify itself as a prosthesis of the state.

HT: So, as you say, when does the self-professed purpose of the corporation change from being something that was beneficial for the commonwealth to something that benefits the corporation itself? Most of the rhetoric that I see in Hakluyt is immediately concerned with the activities of the company itself: survival, getting back [to home port] safely, opening up the market, identifying and finding commodities that are highly desirable, and producing a profit—although you rarely encounter naked statements about profit because they are actually so consumed with the more immediate question of survival, information-gathering, and interpreting objects. You see these types of statements a lot in the material Hakluyt prints from the early trading corporations. [His narrative includes questions like:] Where are we? What does this thing or that word mean? How do we get from here to there? This man said this: does this mean that another statement is also true?

Now, when you get above these to a global justification for the venture, you find that they are almost always voiced in terms of the largest political association, which they call the commonwealth. And they speak in terms of natural law principles: the idea that their activity is beneficial to, or a general attribute of, all humanity, of all people—that trade among people is a form of friendship, for instance. It’s a neo-Roman, Ciceronian justification for how commerce and trade fits into the larger public, communal, political body. They use a lot of this type of language, too.

JG: I can’t imagine a major multinational ever thinks about the state or the sovereign or the nation.

HT: I think modern corporations today often address themselves to individual subjects. Nike is a really good example. Your association with Nike is a kind of personal betterment, a form of extreme humanity. [Nike’s rhetoric and optics suggest statements like:] “Perform at a higher level.” “Push yourself physically and mentally.” “You’ll have more intense experiences.” “Your highs will be higher, you’ll have fewer lows, your body will be stronger.” “You will live longer and go further and faster.” This intensified phenomenological experience is the destination for all of these corporate imaginaries. It isn’t aimed at a large collective, or a public, much less at a political body.

JG: This close relationship between the commonwealth and economic activity: can we say that it begins in the period you discuss in “Humanism and Political Economy,” when economic concerns start to be more explicitly linked to questions of the public good?

HT: It seems to me that it starts in the 16th century, as least in the English-speaking world; in other parts of Europe, it may have started earlier. Speaking for myself—I’m an early modernist, after all—you see many of these concerns as of 1516, in Thomas More’s Utopia. It’s the first book that provides a contemporary dialogue about contemporary economic problems and the way they affect questions of justice. In Book Two, More gives us an entirely different model of political organization, a large-scale group living together, reproducing a whole society and a whole system of value based, among other things, on common property—on no private property at all. More is very interested in this. He grasps some of the most significant economic developments of his period—commodification and private property—and he inverts them and uses that inversion as the foundation for a new utopian society.

As you proceed through the course of the 16th century, more and more people start to become involved in enclosure debates and actual riots or uprisings about the enclosure movement. And at the same time, the period sees the expansion of overseas trade and the complications of a globalizing market and the need on the part of the Crown to understand increasingly complex economic phenomena that underlie its own stability. And so it consults with merchants, who have their own debates over prices and policy in the 1620s and 1630s. People begin thinking and talking more about why prices are going up and why prices are going down, about sources of inflation, about whether there is a relation between famine and inflation and how we understand it, about the value of newly imported manufactured goods—whether they are substantial, enduring luxuries or necessities, things the English should be cultivating.

This is an early moment where you see the emergence of economics and economic mechanisms as a distinct discipline or technical area of thought, and you see people like Sir Thomas Smith talk about it in reference to a large political concept like the commonwealth. Their justification for undertaking these industrial projects is that they will benefit the commonwealth.

More is also thinking about this. In Book Two of Utopia, we see that a central object of the governing authority of Utopia—its senate and governor—is to manage resources, and manage people, and to manage people as resources. It sees them as units that can be quantitatively defined and can be moved from family to family and city to city to make sure that everything is equitably distributed. The government manages all the raw materials and resources for consumption that are necessary to be distributed to everyone and makes sure that the political body is irrigated and nourished and is smoothly functioning. It’s an idea that we associate more with the political economy of the 18th and 19th centuries. So that is a good example of a moment where a political idea of political governance and legal power and authority over state territory becomes inseparable from integral problems of economic management. That seems to me novel in the long time scale that we’re talking about, [and this distinction becomes especially stark] if you compare it to Aristotle’s theories of politics, for instance.

JG: In the “Corporate Ego” article, you say that the market is the unconscious of the corporation. The word market doesn’t appear in the rest of the article. Can you tell me what you meant by the market here and can you expand on how it acts as the unconscious?

HT: Basically in that article I was trying to draw analogies between the psychoanalysis of natural persons and Freud’s account of the conscious/unconscious and primary/secondary processes, and [I applied these to] the idea of a corporate person and a certain kind of economic logic. I was trying to draw an analogy between forms of value in a capitalist system and Freud’s idea of libido. Broadly speaking, Freud’s account is that unconsciously, at the level of the primary processes, this libidinal energy is more or less free, more or less bound into images, words, affective memories, the formalized experiences that we apprehend in dreams. The process of binding or unbinding of libido is what gives shape to the unconscious and from there to conscious life.

I was exploring the idea that the same thing is true of corporate persons, if you substitute “value” for “libidinal energy.” They’re going out into the world with a certain reserve of value. This value takes different forms. It can be very abstract like a ledger book—a purely abstract account of value. But it can also be money, or capital goods of various kinds, like raw materials, commodities, resources that are going to be sold, traded, bartered—all different ways that people conduct their economic business. They load ships with this physical stuff. Value has been concretized into a variety of different forms, including fairly immaterial forms of writing.

The corporate person sails out into the world, and it starts to think about ways it could loosen up the capital value, bind it into objects, then increase it, then loosen it up, then re-bind it again, and then increase it further. This is its whole purpose. It wants to find other forms of value that it hasn’t anticipated, and it wants to find new ways to release that capital value and transform it into, ultimately, money that goes back to a group of people, and to individual persons.

Insofar as that process starts to take place, these corporate persons begin to generate a little micro-market. So the word “market” there simply means any form of structured transaction where capitalized value begins to change form. By capital, I mean value that’s intended to produce more of itself, to produce a surplus.

Any time you have a company moving around its agents and its ships, trying to create the circumstances where money value or exchange value or surplus value is used to create more of that value, then you have a market. It’s not something that exists in a natural state. It doesn’t have its own natural laws in the way neoliberal economics wants to believe. It’s entirely structured by the activity of the company—the things the company is able to do, the kind of substances that it has, what it can carry on the boats and what it can’t, its accounting procedures and its mathematics, its technical sophistication about calculation, the places it has the rights to go and the places that it can’t go, the protocols that govern all of its different transactions. All of these are part of the economic ecology of the company.

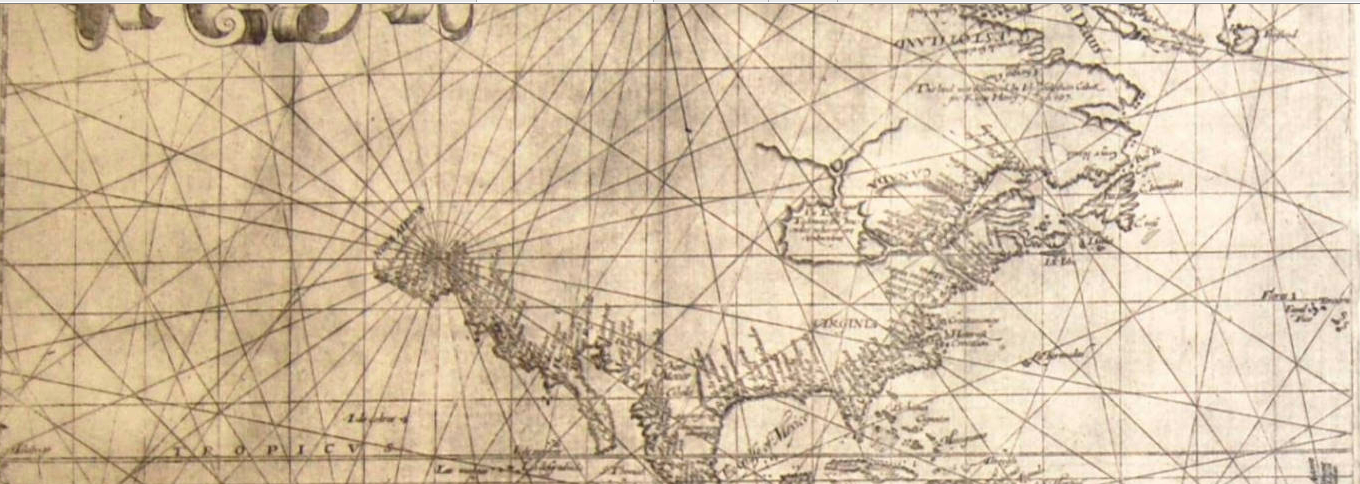

If you were to draw a diagram of the market, you’d have to draw something that looks a lot like the map I printed in the differences article, where you see these roving centers that extend rings out in different directions.

Fig. 2: Detail of Edward Wright's map of the then known world: for Hakluyt's Principal Navigations, 1600. Reproduced from the original in the John Carter Brown Library, Brown University, 1978.

It is a network model, in short. The market is simply all these different fine networks of transactions and points of translation—I really was trying to work with this key Latourian idea—where value changes form from one object to another, ultimately ending in money or, say, in an abstract form like an account book or a form of credit and interest. It’s a very practical definition of what market activity is. It’s an anthropological definition.

JG: So it’s not the unconscious operating in the public-sphere sense of the term, producing illogical dreams of domination?

HT: Well, the trading corporation does write about its desires for the market [like a human would speculate about dreams]. It does have dreams. It does write about its narratives and says, “Oh, we’re sailing here in pursuit of this thing, and we talked to so-and-so and we think there’s more of this here, and we have these letters from these people who went over here and they said they saw a lot of this substance that seems valuable, and these people have this word and it seems to mean copper and we’re interested in that.”

I felt like the corporation has different ways of writing, and that this was a better way of thinking about the conscious and the unconscious. Maybe the unconscious was ultimately everything that wasn’t in writing. The secondary processes are the diaries and letters and the reports back to the governing body and the commands and the structures that the governing body issues out.

Once you get writing, once you get to the discursive form, whether it’s simply a list or a list of rules or a more extended account of how they got to where they were going or a justification for the activity of the company and the venture—all the different kinds of discourse that circulate in the company—that’s the secondary process in the corporate person. That’s the way the company understands the primary process, which is the movement of value. This is only apprehensible to us in the way it’s written about or in the physical objects: we can go and stare at the deck of the ship and see the commodities, like furs, piled up on it. We are looking at a physical manifestation of capitalized value, or something that could potentially be capitalized. We can look at the account book and see it in another form.

Just as with the unconscious, you can never get below that level. You can’t actually get to value itself; you can only get to the representation of the value, in the form of the fur, or the copper, or the wax, or the wood—only representation doesn’t seem like the right word to me. This is exactly what Marx is after: how do I know the value of a coat? I compare it to another object. This conceptual translation happens in Marx’s account, too.

So the market is another word for the unconscious when you’re thinking about the commercial dimension of the corporate person.

JG: The corporation’s unconscious is what underpins the communication, the representation, all the activity.

HT: The market is what’s left in the wake of the activity. The market doesn’t precede those actions. The market is made by those actions. That’s what’s left behind. The market is the structured repetition of transactions, the conventional ways of translating one form of value into another form of value. The market is a set of formalized, repeated techniques and ways of translating value from one form to another.

JG: There is an element of desire that mobilizes that translation, the naked desire that drives the translation of value.

HT: Absolutely. There is also a desire, as you pointed out in one of your [pre-interview] questions, to remain coherent as a body that can continue to undertake this activity. That’s the dilemma of a corporation. It has to maintain its unity, but it has to dissolve itself or be open to the idea of a new combination of elements that would, in a sense, pull it apart. This is the problem with innovation.

In addition to that desire, I sometimes wonder whether corporations want to create a fantasy where there is no responsibility for action. I think this is what people object to about Citizens United. The idea of legal personhood is being used to create an anonymous general group person that acts without responsibility, that acts without accountability. We don’t know who is doing the action. We can’t slap a wrist; we can’t put handcuffs around a wrist. There’s nobody to punish. No one to take responsibility for the decisions. The fantasy of a corporate person is the fantasy of a person without the qualities of moral responsibility that people attribute to a normal person.

JG: I agree. One of the things that I think is part of the production of the fear about corporations is that—one of the characters in Richard Powers’ 1998 novel Gain says this—there’s no place to put a bomb. You couldn’t blow up the corporation because it isn’t actually housed anywhere.

HT: This is really interesting. I think you could. If you do a fine-grained materialist analysis, and you start to see the corporation not as just this group person that’s a big floating bubble that’s impenetrable, but actually as a structured network of relationships and translation points and movements and delegation of voice, all these different ontologies I described earlier—well, then one of the virtues of the materialist ontology of corporations, for instance, is that it reveals points of intervention we can make. You can decide where to protest. You can identify the pressure points, the joints that hold the corporate, artificial person together, you can put pressure on the joints more effectively.

JG: The fantasy of revolution, though, is the storming of the czar’s palace. The fear of the corporation is that we don’t know what to storm.

HT: This is why revolution isn’t always the most effective fantasy of social change. A more effective fantasy of social change is rediscovering the corporate bodies that we’re already members of, articulating more clearly and more self-consciously the systems of value that organize our purposeful life in these organizations, these corporate bodies, and pitting these systems of value against other entities. That’s what a public sphere is for.

JG: It seems to me that there isn’t the kind of energy behind the rediscovery of the collectives that we are a part of, in the way that you’re interested in. Daniel Rodgers has talked about post-identity politics—Walter Benn Michaels has discussed this, too. Each of them argues that identity politics have inadvertently led to this very strong focus on individual identity. This is why I was excited, and I think I still am, about the idea of the 99%.

Fig. 3: Detail of “Occupy Oakland General Strike on October 2nd,” 2011. Photo by Brian Sims. Wikimedia Commons.

That gave a name to a different kind of collective. But what has to happen is that we need to learn how to operate within those collectives and sustain those collectives to give them the durability that the joint-stock corporation has, the perpetual life that it has, and not continue to rely on collectives that are less productive.

HT: What we’re talking about is proliferating nonprofits. When I talk about these ideas [at conferences or with colleagues], I usually ask some simple questions. Think about a group that you belong to that you care about. Think about why you care about the group. Try to write, in three sentences, what you think the purpose of the group is. Then you’ll have a more enhanced sense [of what collectives are for and are capable of doing].

This is what the Society of the Arts of the Corporation is all about. This is a new experiment I’m trying out, and you can find out more about it at its website. It’s a virtual idea, a form, in which we could experiment with the idea of collective association and action: what makes them cohere, what makes them last and become enduring? How could we do that in a public way?

The idea would be to start a new form of group, a new corporate affiliation that would have as its purpose thinking about the nature of group associations in a more self-conscious way, and then demonstrating itself by acting in a way that furthers deliberation about the purposes of collective organizations. I’m sure some people will laugh and say this is too meta-corporate! But to me it makes perfect sense.

JG: When I talk about the idea of group identity, I can’t find anybody that doesn’t find it fascinating.

HT: I’ve encountered a lot of resistance to the redescription of the word corporation. I get a lot of reactions in which people say, “I hate the corporation. Why should your redescription of a word have any legitimacy? Why do we need to reinscribe this word, like the way that queer was once reappropriated? Why should that happen with corporation?”

JG: I’m sure you have an answer for these points. But I would say the way we academics talk about corporations now is incredibly unproductive. And people seem deeply attached to the fears they have of the corporation. This seems to me potentially to drive the alarm people feel at recent Supreme Court decisions legitimizing some corporate activities. I’m curious whether you see the Citizens United and Hobby Lobby decisions as changes in degree or in kind to the nature of the joint-stock corporation.

HT: Changes of degree. The history is there, and it’s a hugely long history. There are significant expansions in the American 19th and 20th centuries around the protections that are afforded to corporations as persons, starting with the 14th Amendment, and those are quite different, naturally, from the cases and the law in the Renaissance period. But there are surprising continuities in terms of the basic definitions and basic categories.

The justices are working with incredibly old ideas with a remote origin, and in some ways [these ideas about the corporation are] in a continuous transmission. It would be interesting to see how often someone like Blackstone on the corporation is cited in American corporate law.

The case of Sutton’s Hospital is probably the most important early modern case in English common law that defines the nature of the corporation aggregate, what it takes to form one, what its requirements are, what its purposes are, what its relationship is to its board of governors and to the property to which it is attached. It’s a case that you also see getting mentioned, occasionally, in legal writing today.

There is probably a lot more continuity.

JG: To speak to that continuity, Kennedy’s style is very citational: he quotes a lot. It’s difficult to extract a line without a quote. In this case, the solution to the problem of corporate donation being a defense of corporate speech—this is the leap in argument that people object to.

HT: I think everyone objects to that: taking money as a form of speech. But you can see the logic.

JG: Because, well, how does the corporation speak? It pays.

HT: It hires people to speak for them.

JG: It seems in one way to legitimize things the corporation already did, as opposed to giving it something else it can do.

HT: My question about the case is: to what extent is the defense of speech really the defense of something we would call authentic group speech, in all the philosophical, rhetorical, and formal complexity of that idea, or to what extent is it really a veiled protection of the speech of a certain sub-group of people who form part of that corporation, and of their political and ideological views?

To what extent does the case wrestle with the difficulty of the idea of authentic group speech, which is a really profound question of consensus and dissensus? It’s an incredibly difficult problem, and I’m not sure it’s a problem that’s solvable in an easy way or a legal way.

To the extent that the decision gives some set of definitions and some set of arguments and some traces of precedents that would help us think about the problem of group speech in its full complexity and the issues that are involved in it, then it would be a valuable decision. To the extent that it ignores those things, it seems to be a hypocritical decision, in the sense that it’s using a principle of personhood and an analogy between artificial and natural persons in an opportunistic way to basically protect the speech of a minority rather than the speech of the entire group. That representative model of thinking about group personhood —the representational ontology—can be a very impoverished way of thinking about it. I don’t think you can say that a simple majority should rule, in the case of determining an identity or the purpose of a group. But what the alternative is, I freely confess I don’t know, beyond a model of ongoing deliberation within itself. But when the body has to make a decision, take an action, set a regulation, set a course of action, do something collectively—not everyone’s going to agree.

Works Cited:

Citizens United v. Federal Election Commission. 558 U.S. 1-57. Supreme Court. 21 Jan. 2010. Supreme Court of the United States. Web. 25 Sept. 2015. <http://www.supremecourt.gov/opinions/09pdf/08-205.pdf>.

Copeland, Nicholas, and Christine Labuski. The World of Wal-Mart: Discounting the American Dream. New York: Routledge, 2013. Print.

Latour, Bruno. Reassembling the Social: An Introduction to Actor-Network-Theory. Oxford: Oxford UP, 2005. Print.

Marx, Karl. A Contribution to the Critique of Political Economy. New York: International P, 1970. Print.

Marx, Karl, and Friedrich Engels. Capital: A Critique of Political Economy. New York: International P, 1967. Print.

Michaels, Walter Benn. The Trouble with Diversity: How We Learned to Love Identity and Ignore Inequality. New York: Metropolitan, 2006. Print.

Micklethwait, John, and Adrian Wooldridge. The Company: A Short History of a Revolutionary Idea. New York: Modern Library, 2005. Print.

More, Thomas. Utopia. Trans. Paul Turner. London: Penguin, 2003. Print.

Rodgers, Daniel T. Age of Fracture. Cambridge, MA: Belknap P, 2012. Print.

Turner, Henry S. “Corporations: Humanism and Elizabethan Political Economy.” Mercantilism Reimagined: Political Economy in Early Modern Britain and Its Empire. Eds. Phillip J. Stern and Carl Wennerlind. Oxford: Oxford UP, 2014. 153-176. Print.

---. “Towards an Analysis of the Corporate Ego: The Case of Richard Hakluyt.” Differences: A Journal of Feminist Cultural Studies. 20.2-3 (Summer-Fall 2009): 103-147. Print.

Figures:

Fig. 1: Harlan, Manuel. Act 1 Scene 3, The Ghost of the old King Hamlet (Greg Hicks) appears at night to Hamlet, Horatio and Marcellus, 2004. Royal Shakespeare Company. rsc.org.uk. JPEG. 6 Nov. 2015.

Fig. 2: Wright, Edward. Detail of Edward Wright's map of the then known world: for Hakluyt’s Principal Navigations, 1600. Reproduced from the original in the John Carter Brown Library, Brown University, 1978. Huntington Digital Library 471098. JPEG. 6 Nov. 2015.

Fig. 3: Sims, Brian. Detail of Occupy Oakland General Strike on October 2nd, 2011. Wikimedia Commons. JPEG. 6 Nov. 2015.

Back to Issue 8 Table of Contents